The Porter Five Forces analysis model first appeared in a Harvard Business School professor Michael E Porter published in Harvard Business Review in 1979. The publication of this paper has historically changed the understanding of strategy among enterprises, organizations, and even countries. It was named one of the ten most influential papers of Harvard Business Review since its inception.

A Five Forces analysis can help companies assess industry attractiveness, how trends will affect industry competition, which industries a company should compete in—and how companies can position themselves for success.

Five Forces Analysis is a strategic tool designed to give a global overview, rather than a detailed business analysis technique. It helps review the strengths of a market position, based on five key forces. Thus, Five Forces works best when looking at an entire market sector, rather than your own business and a few competitors.

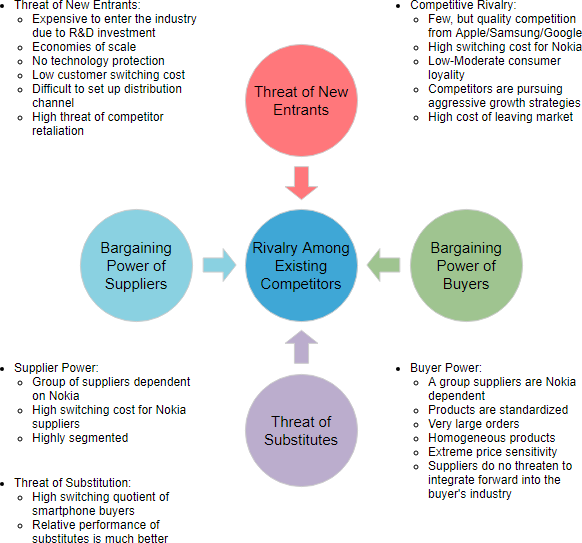

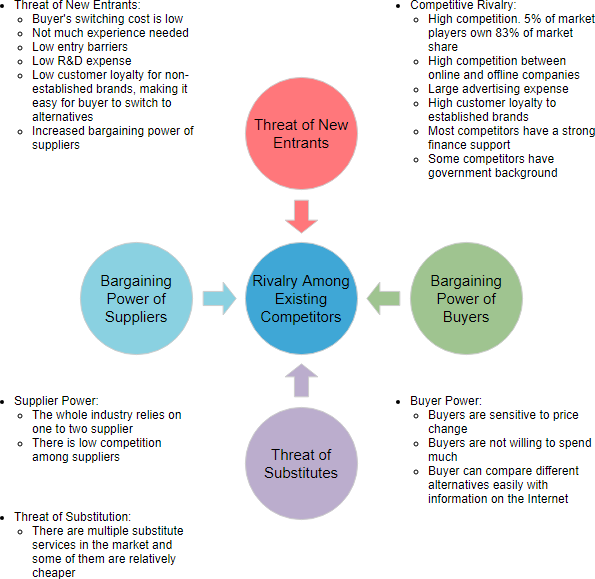

The main idea of this model is that the key to an enterprise obtaining a competitive advantage lies in the profitability (industry attraction) of the industry in which the enterprise is located and the relative competitive position of the enterprise in the industry. Therefore, the primary task of strategic management is to select potentially highly profitable industries by analyzing five factors including suppliers, buyers, current competitors, alternative products, and potential entrants. After selecting industries, enterprises should choose one of three strategies, such as low-cost, production dissimilation or centralization, as their competitive strategy, based on their strength and the comparison of the five forces.

Porter’s five-force analysis model has a global and profound impact on corporate strategy formulation. Applying it to the analysis of competitive strategy can effectively analyze the customer’s competitive environment. Its application range from the initial manufacturing industry gradually covers almost all industries such as financial services, high technology and so on.

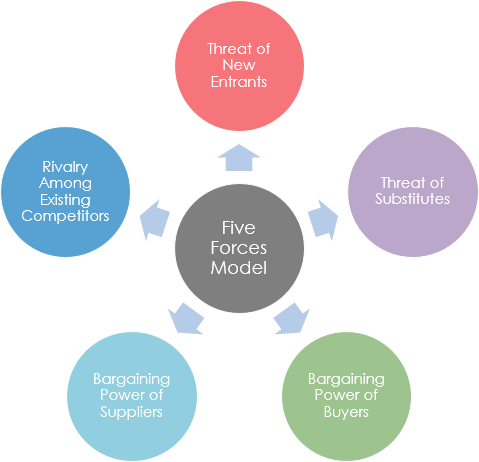

The Porter Five Forces model brings together a large number of different factors in a simple model to analyze the basic competitive landscape of an industry. The Potter Five Forces model identified five main sources of competition, namely:

When the input elements provided by the supplier constitute a large proportion of the total cost of the product to the buyer, the potential bargaining power of the supplier is greatly increased. In general, suppliers who meet the following conditions will have stronger bargaining power.

Buyers mainly influence the profitability of existing companies in the industry through their ability to lower prices and requirements to provide higher product or service quality. In general, buyers who meet the following conditions have strong bargaining power:

The total number of buyers is small, and each buyer purchases a large amount and accounts for a large percentage of the seller’s sales

The seller’s industry consists of a large number of relatively small companies

The purchaser purchases a standardized product, and it is economically feasible to purchase the product from multiple vendors at the same time.

Suppliers facilitate forward integration, while buyers find it difficult to combine or integrate backward.

New entrants, while bringing new production capacity and new resources to the industry, hope to win a place in the market that has already been divided by existing companies. This may cause competition with existing companies in raw materials and market share, resulting in the existing industry. The level of corporate profits is reduced, even threatening survival.

The severity of competitive entry threats depends on two factors: the size of the barriers to entry into new areas and the expected response of existing businesses to entrants.

Barriers to entry mainly include the following factors:

Two companies in different industries may generate competing products because of the products they produce are alternative products.

Enterprises in most industries are closely linked to each other’s interests. As part of their overall strategy, their goal is to make their own companies more competitive than their competitors. There are conflicts and confrontations, often manifested in prices, advertising, product introductions, and after-sales services.

Porter Five Forces provides tools for in-depth analysis of the company’s industry, helping companies understand the competitive environment, correctly grasp the five competitive forces facing the company and formulate a strategy that is beneficial to the company’s competitive position. In general, the Potter Five Forces model has the following characteristics:

Porter’s five-force analysis model is a powerful tool for companies to conduct environmental analysis, especially industry analysis, but it is not all of the company’s strategy. Enterprise applies Porter’s five-force model also needs to be balanced both internally and externally.

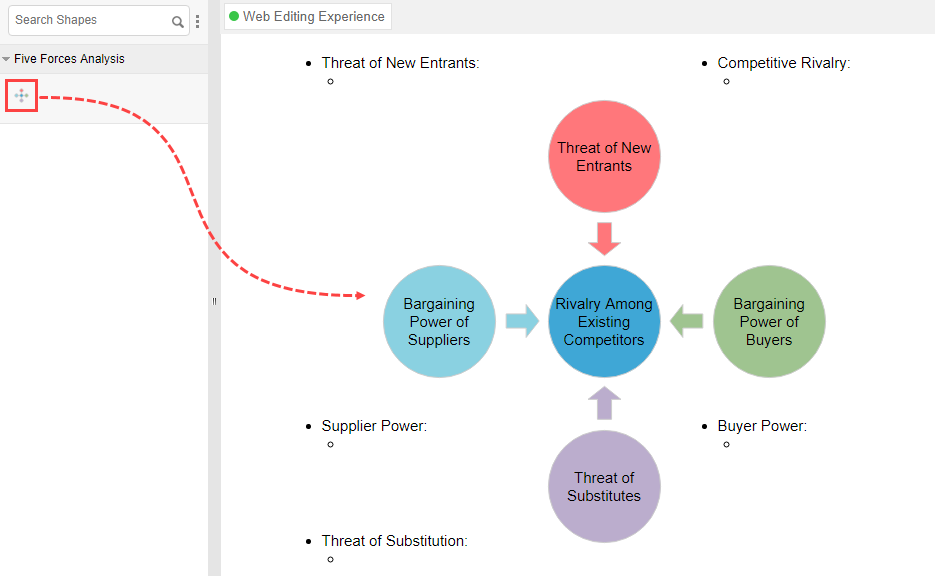

The Five Forces are the Threat of new market players, the threat of substitute products, power of customers, power of suppliers, industry rivalry which determines the competitive intensity and attractiveness of a market.

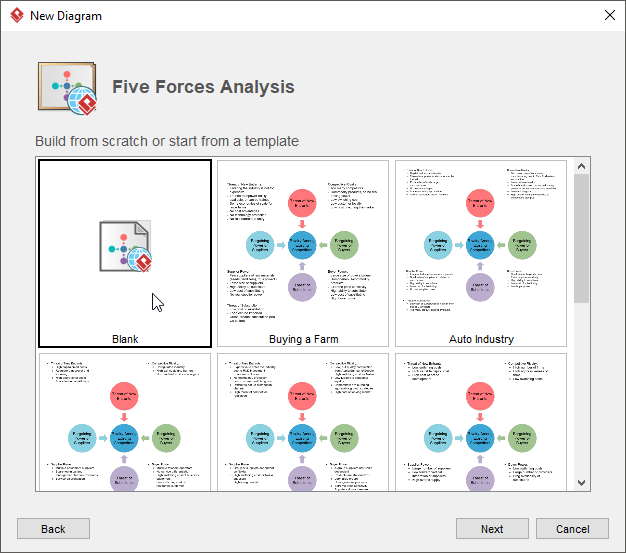

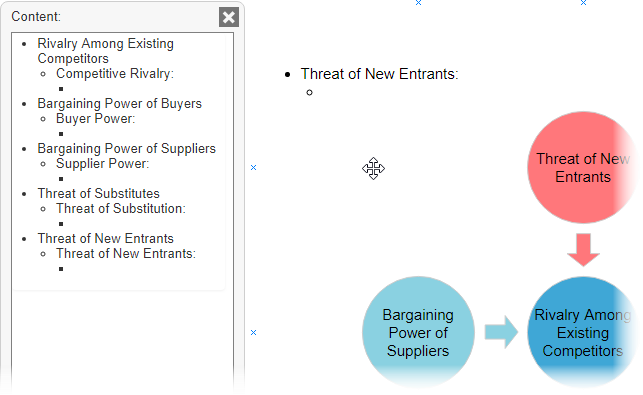

Let’s see how to perform the Five Forces Analysis in Visual Paradigm. We will use a simple Five Forces Analysis example here. You may expand the example when finished this tutorial.